Internal Rate of Return (IRR) vs. Return on Investment (ROI)

When weighing different investment options to meet your financial goals, it’s important to get an understanding of your potential returns. For example, if you invest $10,000 into an online investment portfolio today, how much can you expect to earn in one year? Two years? Five years?

There are different methods investors can use to calculate the potential and actual returns of their investments. Two commonly used methods are the calculation of the internal rate of return (IRR) and the return on investment (ROI).

It’s important to ensure that when you are considering the performance of an investment, you reflect on both the target and actual IRR. For example, what exactly does it mean when you say that a particular investment has earned a 12.63% IRR? And what does it mean if you said you earned a 20% ROI over five years? In this post, we will compare IRR vs. ROI and break down what can be confusing concepts. We’ll also illustrate how to interpret IRR vs. ROI when doing your own personal due diligence on potential investments.

What is ROI (return on investment)?

Return on investment or “ROI” is a metric that is often used in stock portfolios and refers to a percentage increase or decrease in a cash investment over a period of time. In simple terms, ROI is a way to measure the gain or loss created by an investment, compared to the amount that was initially invested. Essentially, it establishes the rate of return on investing for a particular opportunity.

Return on investment is fairly easy to calculate. First, subtract the original cash investment from the current investment worth. This gives you the raw dollar value increase or decrease over the course of the investment. Second, divide this number by the original cash investment. Here’s the formula:

The resulting figure is expressed as a percentage increase or decrease on the original investment.

Note that this equation does not account for how many years the investment was active. For this reason, it is important to look not only at the percentage increase or decrease (the “cash on cash return” itself), but also how many years that percentage increase or decrease took to occur. Therefore, the return on investment is best expressed as “X% [increase/decrease] over X years.” Otherwise, return on investment comparisons between different investments can be misleading because they might express gains over very different periods of time.

What is IRR (internal rate of return)?

Internal rate of return or “IRR” is harder to calculate than return on investment. However, the internal rate of return formula has the advantage of taking into account the period of time during which investments are made.

This can make it easier to compare asset portfolios and help you choose the one that has the potential to grow your money the fastest. Usually, IRR is expressed as an annualized rate of return—the average percentage by which any outstanding principal grows during each year that your investment is maturing. In other words, IRR represents the annualized percentage rate earned on each dollar invested for each period it is invested (i.e. any money that is “outstanding” or not repaid, continues to earn the IRR at an annual rate, while any repaid principal no longer earns interest).

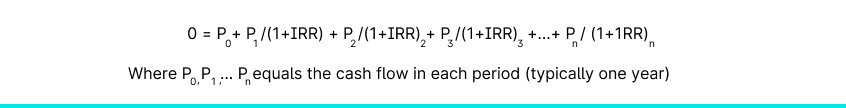

Let’s take a look at how to calculate IRR in order to better understand what IRR is. Unlike the return on investment formula, for most people this formula takes a calculator or Excel spreadsheet to solve if the money has been invested for more than one year:

In addition to accounting for the time during which an investment has matured, IRR addresses many other factors that return on investment does not. Unlike the return on investment calculation, IRR accounts for the amortization of an investment. While this factor makes it more difficult to calculate, it also leads many investors to view IRR as a more accurate and informative figure for evaluating investment opportunities.

IRR definitions and formulas aside, let’s look at how a hypothetical investment would perform in terms of IRR vs. ROI. For these examples, let’s assume that Yieldstreet has designated a target return of 10% on a portfolio.

To begin, let’s say you invest $10,000 into an investment portfolio. Then assume no principal repayments are made within the first three years of your investment.

After one year, your investment will be worth $11,000. Your IRR (in-year growth) is 10%. Your ROI is the same: ($11,000 – $10,000) / $10,000 = $1,000 / $10,000 = 10% over one year.

Internal rate of return and return on investment stop being equal after Year 1. Keeping in mind that interest does not compound on Yieldstreet individual investments, in Year 2, the total value of this hypothetical investment is $11,000 + ($10,000 x 10%) = $12,000. Your IRR in Year 2 is again 10%—your portfolio grew by 10% within the year. Your cash-on-cash return, however, is now ($12,000 – $10,000) / $10,000 = $2,000 / $10,000 = 20% over two years.

This pattern is the same for Year 3. Your portfolio grows by 10% again (a 10% IRR) for a total portfolio value of $12,000 + ($10,000 x 10%) = $13,000. Your return on investment is now ($13,000 – $10,000) / $10,000 = $3,000 / $10,000 = 30% over three years.

Here’s a summary of our first example:

You might notice a pattern in the above example. For the first year of investment, return on investment is the same as IRR. For every year thereafter, the gap in IRR vs. ROI grows, with return on investment consistently exceeding IRR.

However, if the principal is repaid during the duration of the investment, the principal portion that is repaid will no longer be outstanding and as a result, the repaid principal portion will not generate any additional interest.

In a simplistic example, let’s say that as of Year 2, you receive a $2,000 principal repayment. In Year 2 you would have $8,000 of remaining principal outstanding and your investment would earn $800 of interest (as the $8,000 earns the 10% IRR). However, according to the formula previously mentioned, this results in a return on investment of 8.0% for Year 2. Further, in Year 3, if you received an additional principal paydown of $3,000, the return on investment for that year is 5.0% for the remaining $5,000 of principal that remains outstanding. Finally, at the end of the full three-year duration, the total ROI is 23.0% over three years (invested $10,000 and earned $2,300 in interest), the IRR for the three-year investment remains 10%.

Unlike the return on investment, IRR considers only the money that is still actively invested and continues to earn interest at a 10.0% rate. IRR focuses squarely on the performance of your money that is still invested and does not consider the principal that has been returned. The return on investment focuses on both the performance of money still invested and money returned and makes the assumption that the $5,000 returned to the investor over the 3 years does not earn any interest.

We hope that this post has helped clarify the meaning of IRR vs. ROI distinction that you may come across when evaluating investments to find the ones that are best for you. Just remember that when you evaluate the projected “returns” on potential investments, pay attention to the terms in which those returns are expressed.

Understanding the terms in which your returns are reported is crucial to understanding how your money can be expected to grow over time in that portfolio. It is also crucial to ensure that when you weigh investment options against each other, you are truly comparing apples to apples. Remember, the same percentage figure might mean very different things depending on whether it’s expressed as IRR vs. ROI.

What's Yieldstreet?

Yieldstreet provides access to alternative investments previously reserved only for institutions and the ultra-wealthy. Our mission is to help millions of people generate $3 billion of income outside the traditional public markets by 2025. We are committed to making financial products more inclusive by creating a modern investment portfolio.