Amortized vs. Interest-only Payment Schedules

In our conversations with investors, we often get asked about scheduled payments and the variations they see in the breakdown of principal and interest within each payment. Let’s take some time to address the difference between amortized payments and interest-only payments, how that will affect investors’ cash-on-cash return, and the advantages of each type of repayment schedule.

Unlike litigation offerings, which have no set timeline and make event based payments depending when cases within a portfolio settle or are paid out, offerings within commercial lending and real estate often follow a set monthly payment schedule.

There are a few factors that are integral in putting together a repayment schedule.

- The structure of the investment

- The investment amount

- The Annual Interest Rate

- The Repayment Period

The cash-on-cash yield of an investment is the return an investor gets excluding the principal balance repayment, in other words – their return on capital. The biggest factor that will affect cash-on-cash return is the structure of the investment. If the opportunity is structured so that principal is repaid throughout its lifetime, the investor will receive monthly principal + interest payments. If the investment is structured so that principal is repaid as the loan matures, investors will receive monthly interest-only payments and a few principal distributions.

Let’s look at two examples.

Amortized Repayment Schedule

Let’s say you invested $10,000 in a 12% opportunity with a 12 month duration. When the amortization schedule gets put together, a formula determines a set amount to be paid over the 12 months that this investment is active.

The payment for Month 1 is calculated as follows: 12% (target yield) * $10,000 (amt. invested) / 12 (loan duration) = $100. This is the interest payment for Month 1. This interest payment then gets subtracted from the determined monthly payment ($888.49) for a total of $788.49 repaid in principal for the month. The principal portion of the payment is then considered repaid principal, and lowers the overall principal invested in the opportunity, lowering it to $10,000 – $788.49 = $9,211.51.

This makes the calculation for Month 2 slightly different. Instead of using the beginning principal balance ($10,000), the formula will now use the remaining principal balance ($9,211.51) to calculate the principal and interest breakdown for the Month 2 payment. So, 12% * $9,211.51 = $92.12 / 12 = $92.12. This interest payment then gets subtracted from the pre-determined monthly payment to yield $796.37 in principal repayment. The repaid principal gets subtracted from the beginning principal balance, which will get used in the calculation for Month 3, and so on.

An advantage of this investment schedule is that investors have a pre-determined schedule of payments that does not change as the loan progresses, so they can expect the same payment month to month. The payment schedule also returns the principal amount quicker to investors who do not want their money to be tied up for longer periods of time. The downside to this type of repayment schedule is that it can make the target interest repaid at the close of the opportunity confusing for some investors.

Looking at the 12% interest and $10,000 invested, some investors may expect to get $1,200 cash-on-cash return on their investment. For this type of repayment schedule, that would be incorrect, as the principal gets paid down throughout the lifetime of the investment, while the target 12% return is always based on the outstanding principal balance. So the actual cash-on-cash return on this investment would be the sum of all interest payments ($661.85), not $1,200.

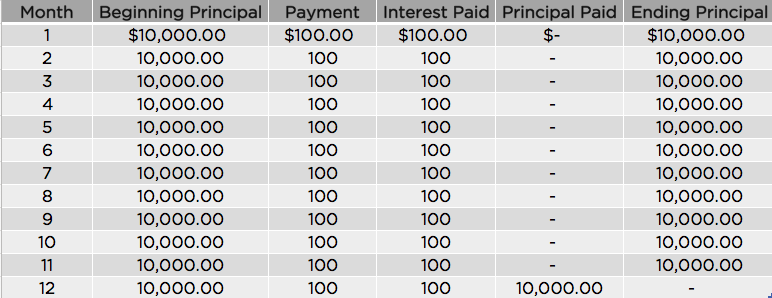

Interest Only Payments

In other cases, the opportunity will make interest-only payments until a part of the loan, or the whole loan is mature. This can happen when an opportunity that features three real estate loans will make three principal payments at the time those three loans mature. Throughout the rest of the cycle, investors will get paid their accrued interest in a monthly payment.

Let’s look at another example using the $10,000 investment in a 12% opportunity over 12 months.

The payment for Month 1 is calculated by multiplying 12% (target yield) * $10,000 (amt. invested) / 12 (duration) = $100. Because this purely an interest payment, it does not get subtracted from the ending principal. In the following months, the same payment is made until there is a principal repayment event at Month 12.

This type of repayment schedule is advantageous for those investors who are seeking higher cash-on-cash yields on their investment. On the flip side, the invested principal is tied up until the end of the investment opportunity, making this type of repayment schedule less convenient for investors who are seeking quick liquidity.

In summary, understanding the differences between various repayment plans is important for investors looking to make smart choices with their investments. Amortized repayment schedules give a steady return of the main sum and interest. The interest-only payments offer higher returns on the money invested but require a longer commitment of the main amount. Each option has its pros and cons, and in the end, the decision comes down to what suits your investing needs and financial goals.

This communication and the information contained in this article are provided for general informational purposes only and should neither be construed nor intended to be a recommendation to purchase, sell or hold any security or otherwise to be investment, tax, financial, accounting, legal, regulatory or compliance advice. Any link to a third-party website (or article contained therein) is not an endorsement, authorization or representation of our affiliation with that third party (or article). We do not exercise control over third-party websites, and we are not responsible or liable for the accuracy, legality, appropriateness or any other aspect of such website (or article contained therein).

What's Yieldstreet?

Yieldstreet provides access to alternative investments previously reserved only for institutions and the ultra-wealthy. Our mission is to help millions of people generate $3 billion of income outside the traditional public markets by 2025. We are committed to making financial products more inclusive by creating a modern investment portfolio.