Extensive opportunities

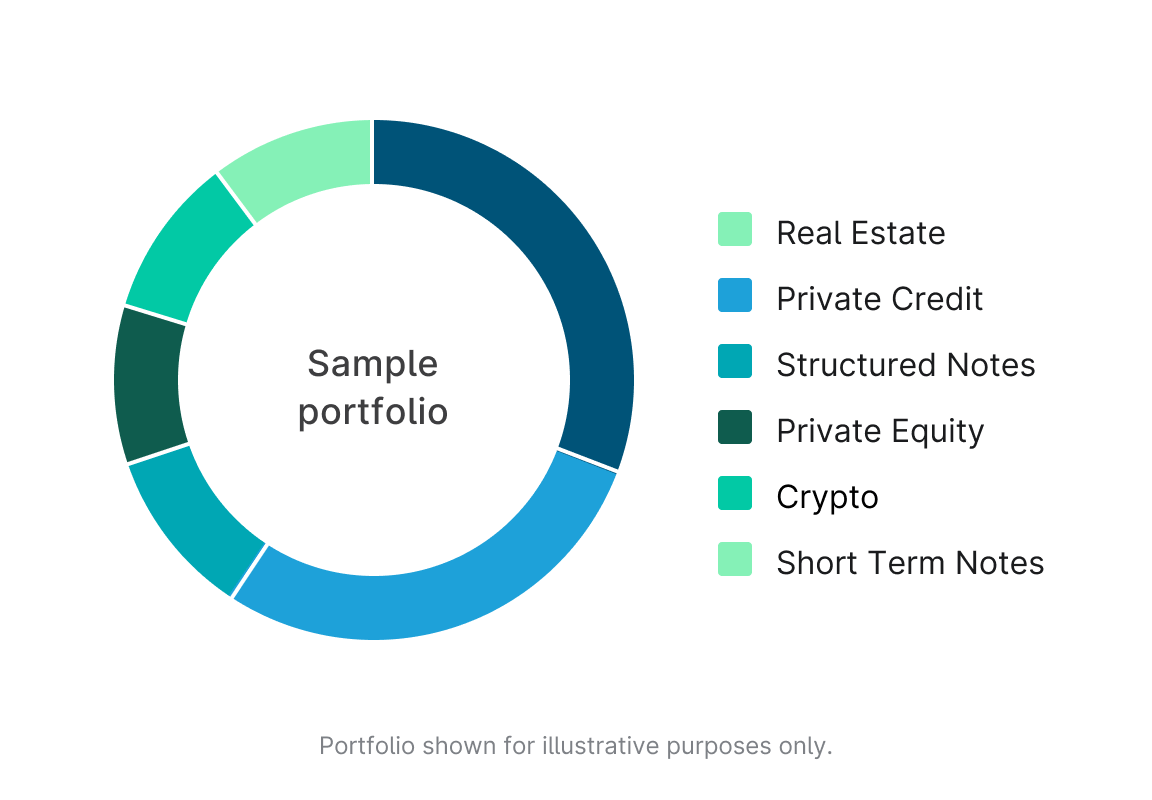

We offer more alternative asset classes for IRAs than any other platform — everything from real estate to private credit to crypto.

Support for all major accounts

Roll over a 401(k); transfer all, or a portion of a traditional IRA, Roth IRA, SEP IRA, or SIMPLE IRA; or contribute new funding.

Get started in 5 minutes

Most accounts can be funded in just a few days, and our concierge team is here to assist every step of the way.

Take your retirement off autopilot

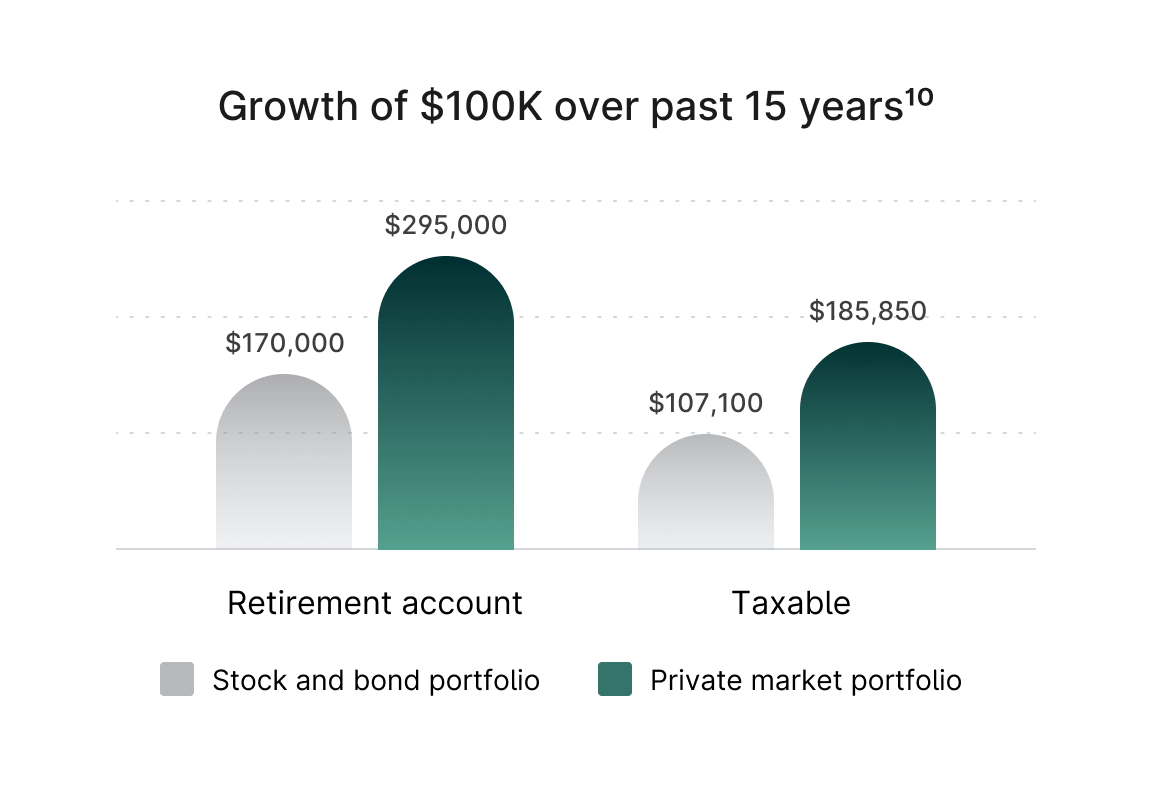

Your retirement dollars are among the most important to optimize due to their tax efficiencies, making IRAs an ideal vehicle for enhanced private market growth and income.

Protect your wealth

Don’t leave your entire retirement portfolio vulnerable to public market volatility. Diversify with generally lower-correlation private assets.

Compound long-term growth

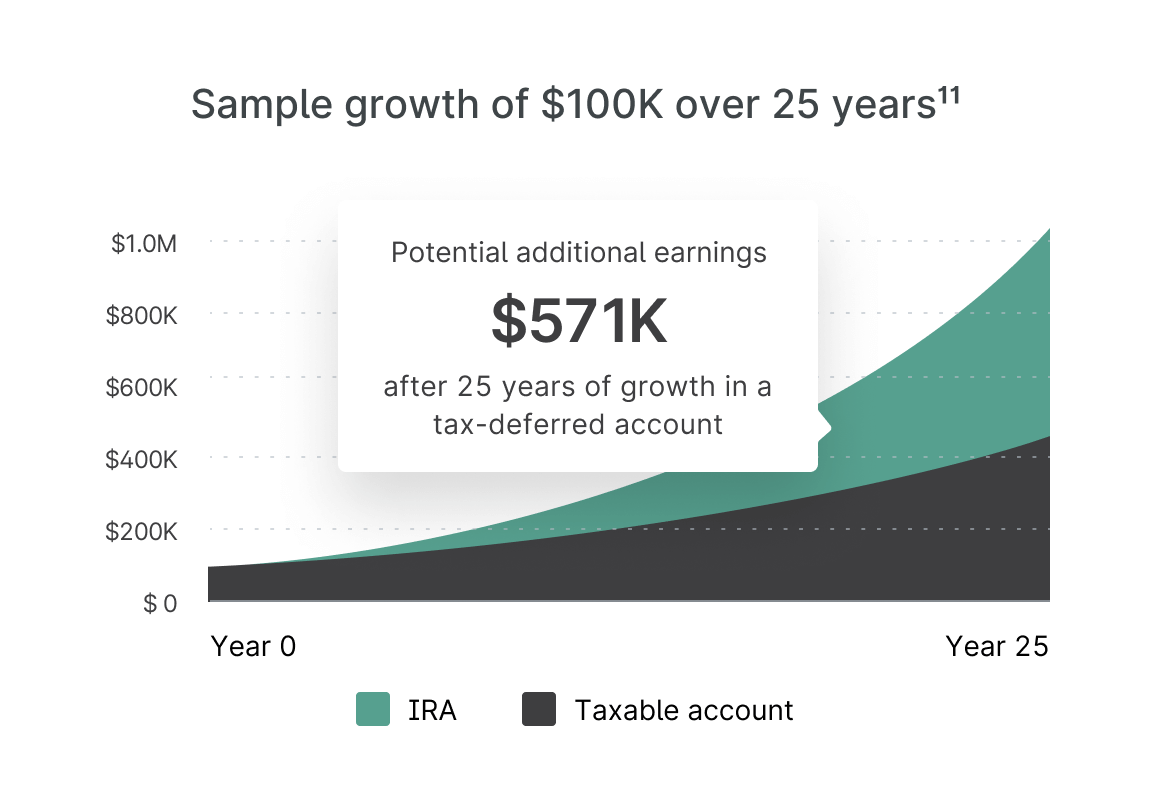

With a generally longer time horizon, a retirement account can be ideal to let less-liquid private market assets target higher risk-adjusted returns.

Keep more of what you earn

Instead of realizing income or capital gains each time a private market investment matures, let it compound with tax advantages in a retirement account.

Extensive opportunities, one platform

We’ve developed innovative structures that unlock previously restricted investments for IRAs. More than 85% of our investments are available to retirement accounts.

Real Estate

Private Credit

Private Equity & Venture Capital

Funds Investments

Short Term Notes

Structured Notes

Reserved access to offerings

Gain access to some of our highest-demand investments, such as our Supply Chain Financing program, with reserved funding for retirement accounts.

Powered by a top IRA account custodian

We offer a best-in-class retirement investing experience through Equity Trust, one of the largest self-directed IRA custodians in the U.S.

$45B+

in assets under custody and administration"Best overall"

self-directed IRA company¹²50

years in businessSource: Equity Trust (January 2024)

Get started in 5 minutes

We’ve made adding private markets to your retirement account nearly as easy as traditional public market investments.

1

Open an account

Create an Equity Trust account directly through Yieldstreet.

2

Roll over or transfer funding

Equity Trust’s concierge team will help you transfer or roll over funding to your account.

3

Add investments

You’re all set to invest in Yieldstreet offerings with your retirement account.

Reduced fees with Yieldstreet

Yieldstreet members enjoy reduced Equity Trust account fees. Pay as little as a 0.09% annual fee based on your retirement account balance.

- 10. Returns based on the past 15 years of historical data from Cambridge, NCREIF, S&P, Bloomberg, as of 6/30/22. Returns are cumulative and do not consider the impact of any fees/expenses. The Private Market Portfolio is a composite index comprised of 40% Private Equity (Cambridge PE Buyout Index) / 30% Private Credit (Cambridge Direct Lending Index) / 30% Private Real Estate (NCREIF Property Index). The Traditional Portfolio is a composite index comprised of 60% Stocks (S&P 500 Index) / 40% Bonds (Bloomberg US Aggregate Index). Indexes are unmanaged and have been provided for comparison purposes only. You cannot invest directly in an index.The taxable account represents a constant tax rate of 37% (the current top ordinary income rate). Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All securities involve risk and may result in significant losses.

- 11. This graph is an illustrative model comparing how an account of $100,000 earning an annualized return of 9.7%, compounded annually, over 25 years would fare in a taxable account versus in a tax-deferred account (IRA). The model assumes no other contributions to or distributions from the account over the period and assumes the reinvestment of any dividends and other earnings. The "Taxable" account reflects the application of a constant tax rate of 37% (the current top ordinary income tax rate) on any such dividends and other earnings each year. The "Tax-deferred or tax-free" account assumes no taxes are assessed on dividends or other earnings in the account.

- 12. Source: Investopedia (as of April 20, 2023). View methodology

- Yieldstreet cannot and does not provide tax advice and this communication is for illustrative purposes only and is not intended to be — and should not be construed as — tax advice. Please consult a tax professional for advice specific to your situation. This communication should neither be construed nor intended to be a recommendation to purchase, sell or hold any security or otherwise to be investment, financial, accounting, legal, regulatory or compliance advice. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All securities involve risk and may result in significant losses.