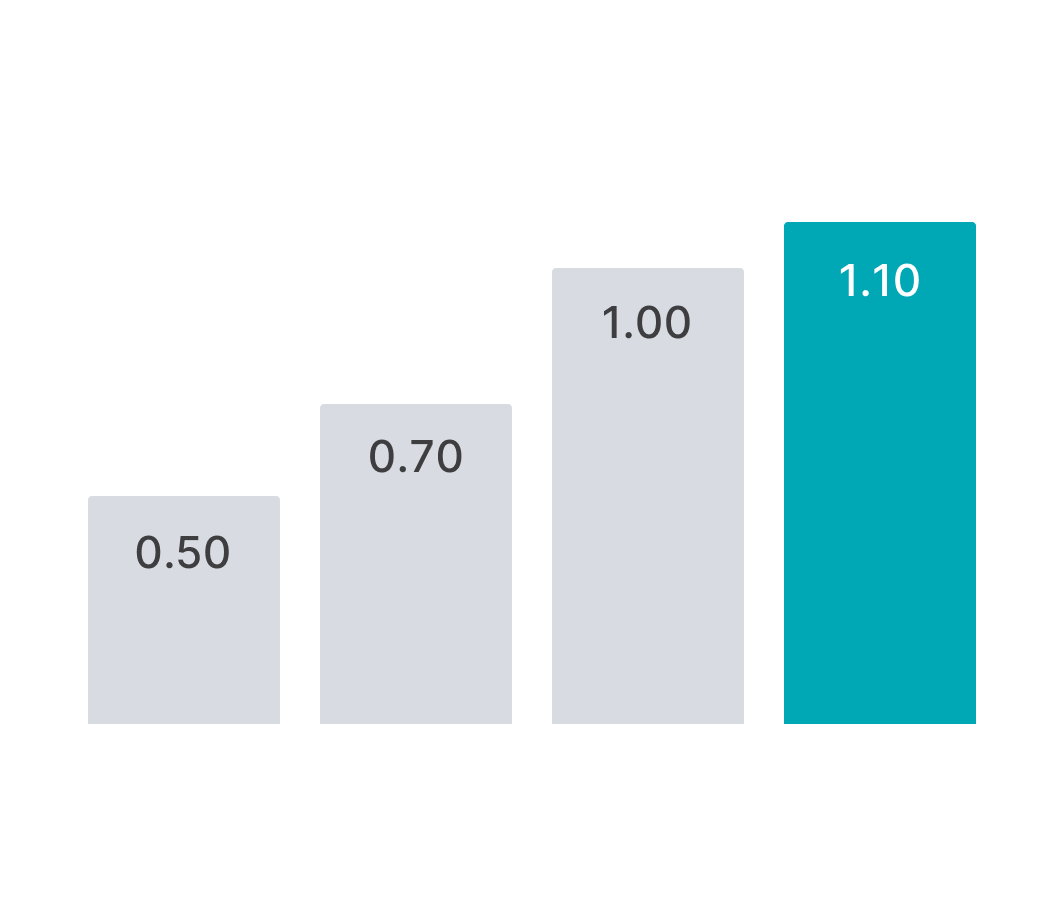

Senior-secured loans pooled into a CLO

Asset managers typically purchase 200+ senior-secured corporate loans to form a CLO.

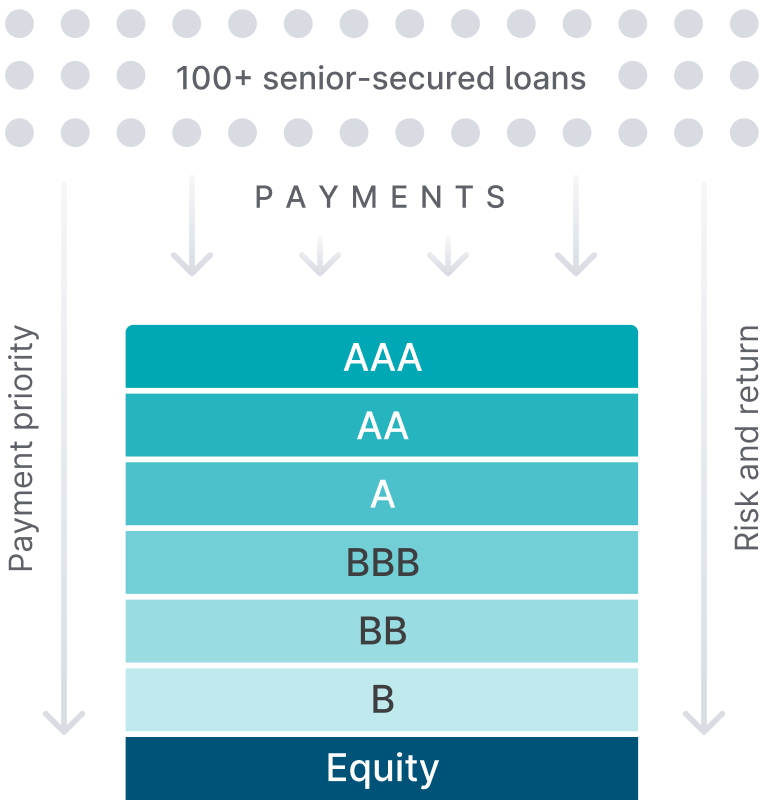

Investors allocate to tranches

To fund the purchase of the loans, the manager sells stakes in its CLO to debt and equity investors.

The debt portion of the CLO is organized into multiple levels, known as tranches, that investors can select from. A final equity tranche sits at the bottom.

Earn quarterly income

As loans in the CLO distribute principal and interest, cash flows from the top tranche down on a quarterly basis.

Not until all interest owed to the AAA tranche is paid does AA receive payments, and so on.

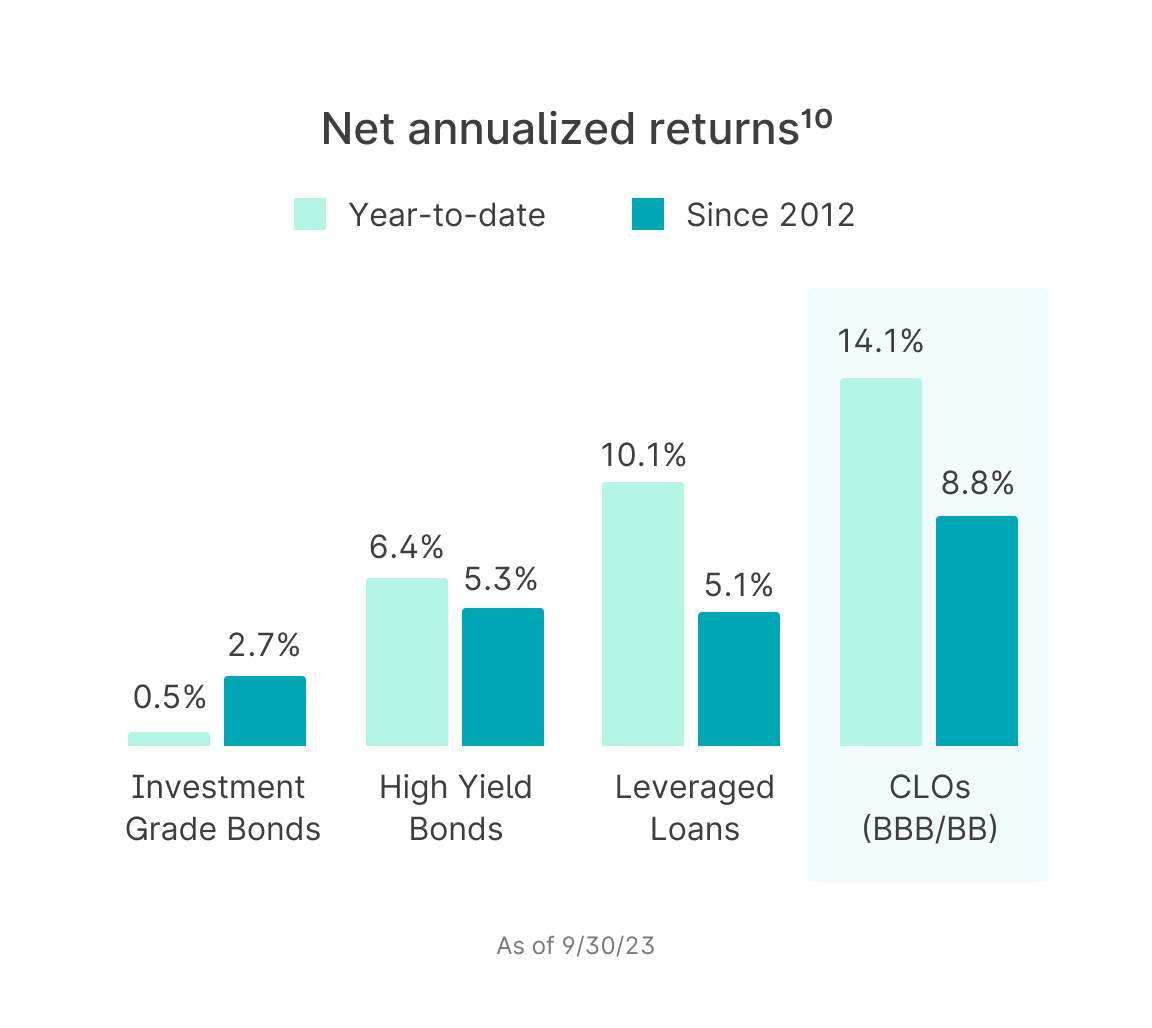

Delivering competitive historical returns with reduced risk

We believe the BBB and BB tranches of CLOs have the opportunity to deliver some of the most attractive risk-adjusted returns in fixed income.

Outperform traditional fixed income

The BBB and BB tranches that our Funds target historically offer higher yields than similarly rated corporate bonds and other structured products.

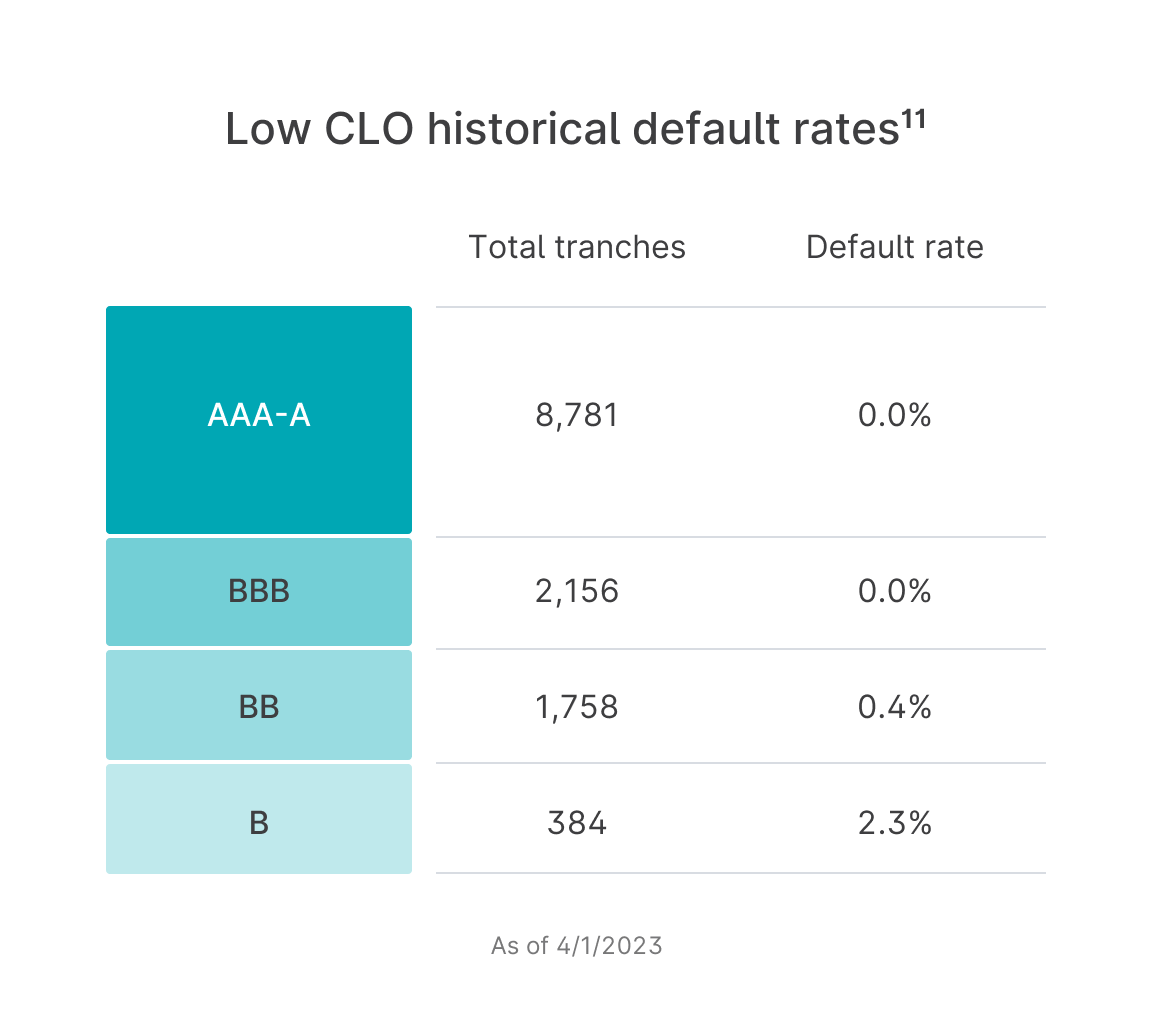

Near-zero default rates

Historically, the CLO structure has proven to be extremely resilient through multiple market cycles.

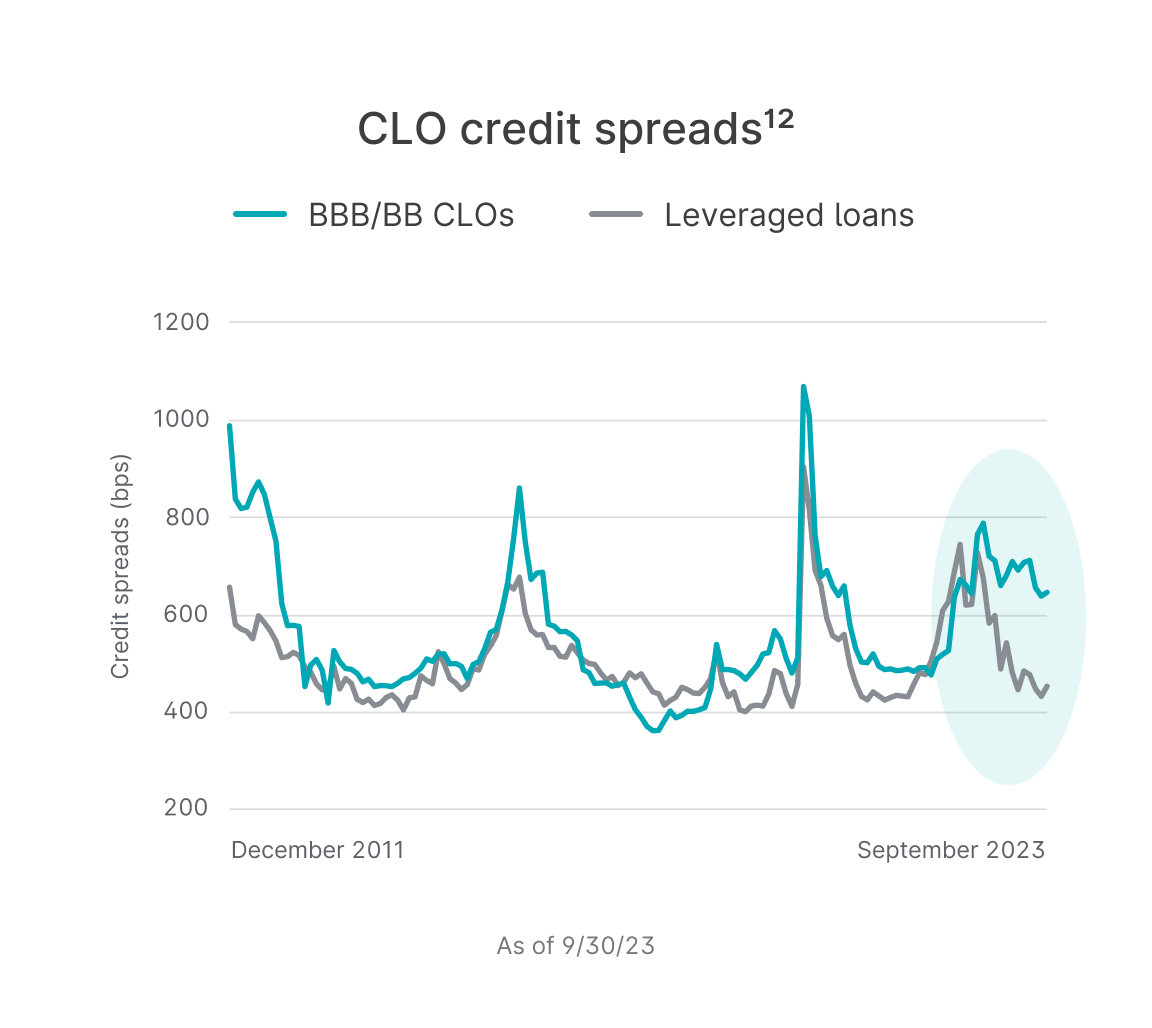

Uniquely wide credit spreads

Wider spreads, a measure of credit risk, allow CLOs to be purchased at a potential discount. As spreads normalize, CLO resale prices are expected to rise.

The first private market platform to offer CLOs

We have partnered with Prytania Asset Management as the sub-advisor for our Diversified CLO Funds.

$1T+

CLO market globally¹³$2.2B+

Prytania AUM20 yrs

Prytania years in businessDive deeper

How CLOs work

These slides explore the fundamentals of CLOs and how the unique tranche structure helps protect investors.

View slidesThe opportunity in CLOs with Prytania Asset Management

Mark Hale, CEO and CIO of Prytania, joined Yieldstreet to discuss the benefits of CLOs for investors.

Watch videoCLOs vs. other investment products

See how CLOs compare to various fixed income and structured products.

Explore the differencesPast performance is not indicative of future performance.

9. Source: Yieldstreet, Prytania Asset Management, JPMorgan, as of 9/30/2023. Data is from the period beginning 12/31/2011. CLOs are represented by the JPMorgan CLO Index, Investment Grade by the JPMorgan US Liquid Index, High Yield by the JPMorgan Domestic High Yield Index and Leveraged Loans by the JPMorgan Leveraged Loan Index.

10. Source: Yieldstreet, Prytania, JPMorgan, as of 9/30/2023. CLO BBB/BB is represented by a custom index of 60% JPMorgan CLO BBB Index and 40% JPMorgan CLO BB Index. CLOs are represented by the JPMorgan CLO Index, Investment Grade by the JPMorgan US Liquid Index, High Yield by the JPMorgan Domestic High Yield Index and Leveraged Loans by the JPMorgan Leveraged Loan Index.

11. Source: S&P Global CLO Spotlight: U.S. CLO Tranche Defaults as of 4/1/2023.

12. Source: Yieldstreet, Prytania Asset Management, JPMorgan, as of 9/30/2023. Data is from the period beginning 12/31/2011. CLO BBB/BB is represented by a custom index of 60% JPMorgan CLO BBB Index and 40% JPMorgan CLO BB Index.

13. Source: JPMorgan. As of Nov 2022.