Evolve your wealth

Take a look back at 2022 as we celebrate a record-breaking year for our investors and company.

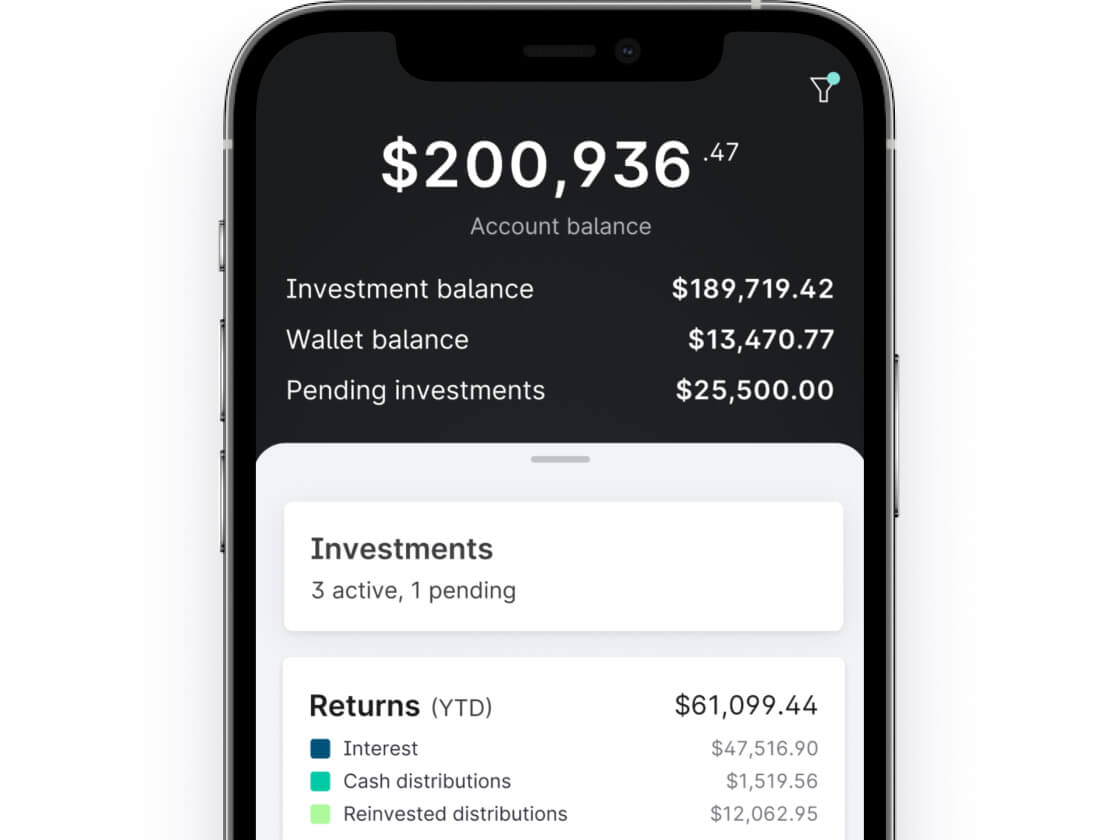

Strong returns, even when public markets falter

A message from our founders

Milind Mehere

Founder & CEO

Michael Weisz

Founder & President

Our greatest year to-date

$1B+

invested on platform this year⁸$600M+

distributed to investors this year⁹135+

offerings launched this yearMilestones

$3B+

invested on platform ⁸$2B+

distributed to investors since inception ⁹400K+

membersThe broadest selection of asset classes

We make it easy to invest like an institution with 135+ diversified offerings launched this year.

Real Estate

20 new offerings

Private Credit

17 new offerings

Venture Capital

4 new offerings

Private Equity

1 new offering

Short Term Notes

39 new offerings

Structured Notes

35 new offerings

Transportation

1 new offering

Art

4 new offerings

Legal Finance

2 new offerings

New opportunities from world-class managers

Taking the investor experience to new heights

A year of awards and accolades

Experience the new Yieldstreet

Say goodbye to the Impala and Oxpecker as diversification takes center stage in our new icon. Plus, we evolved our mission and tagline to speak to the fundamental role private markets play in a portfolio.

Investing in what matters most

Funding for Ukrainian refugees

Yieldstreet and our investors donated $120K in aid to United Hatzalah of Israel to help Ukrainian refugees. The organization used the funding to set up field hospitals and medical centers.

Holiday gifts for children in need

In the spirit of gratitude, we donated a gift for each investment made leading up to the 2022 holiday season. Employees donated nearly 300 additional gifts themselves.

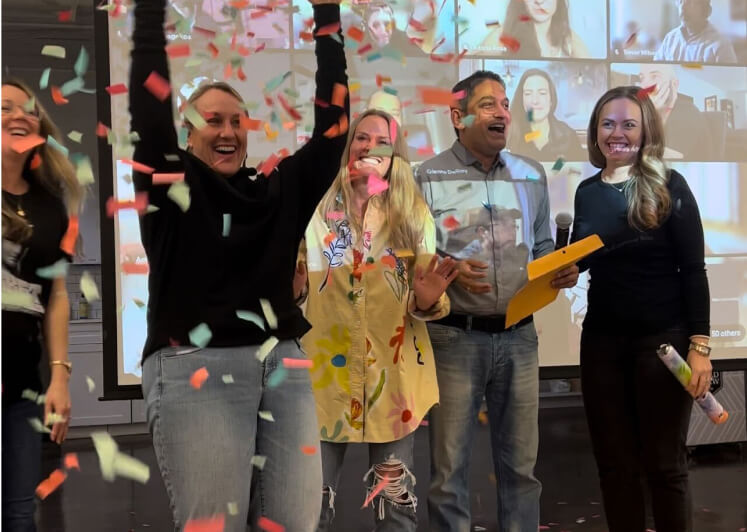

Life at Yieldstreet

Yieldstreet Olympics @ Brazil

Holiday Party

Team bonding

Wednesday office lunches

Yieldstreet Olympics @ NYC

Hackathons

Team celebrations

Investor events

Lunch and learns

A glimpse into the future

See what our teams have in store for 2023.

01

Managed portfolios

Allocate to a diversified portfolio of Yieldstreet investments based on your objectives.

02

Enhanced IRA offering

We’re making it easier to take a tax-efficient approach to private markets.

03

New investment managers

We seek to identify top-tier managers to bring a broad selection of investments.

04

Improved portfolio performance tracking

Gain more insight into performance across the lifetime of your investment.

8. Source: Yieldstreet. As of 12/15/2022. Figure inclusive of leverage and Short Term Notes.

9. Source: Yieldstreet. As of 12/01/2022. Cumulative historical interest and principal returns year-to-date are based on unaudited internal calculations, are subject to change, and may differ from fund.

10. Performance is calculated on a Net Asset Value (NAV) to NAV basis at time of settlement, and reflects the deduction of management fees and all other expenses charged to investments. Performance is based on unaudited internal calculations and subject to change. Past performance does not guarantee future results. It should not be assumed that other current offerings from Yieldstreet or its offerings in the future will be profitable or will equal the performance of this past offering. The historical average net realized return, using an internal rate of return (IRR) methodology, with respect to all matured investments, except our Short Term Notes program, weighted by the investment size of each individual investment, made by private investment vehicles managed by YieldStreet Management, LLC from 7/1/15 through and including 12/1/22, is 9.7%.

11. Source: Yieldstreet. As of 11/30/2022. Past Performance is not a guarantee of future performance. This figure is calculated by dividingthe number of matured offerings, excluding our Short Term Notes program, managed by YieldStreet Management, LLC since inception that have performed within 0.5% of their targeted return, or better, by all such matured offerings. Where targets were expressed as a range, the midpoint has been used. Numbers presented are rounded to the nearest decimal.

12. The net annualized return represents a historical average net realized return, using an internal rate of return (IRR) methodology, with respect to all matured investments, except our Short Term Notes program, weighted by the investment size of each individual investment, made by private investment vehicles managed by YieldStreet Management, LLC from January 1, 2022 through and including December 20, 2022, after deduction of management fees and all other expenses charged to investments. Past Performance is not indicative of future results. Cumulative historical interest and principal returns since inception are based on unaudited internal calculations, are subject to change, and may differ from fund returns and payments that an investor will actually receive.