What is Invoice Factoring?

In this article, we discuss Invoice Factoring, a financing arrangement that helps businesses receive necessary working capital between customer orders.

What is Invoice Factoring?

Invoice Factoring is the practice of using a business’s customer invoices as collateral to obtain cash advances from a third-party finance company.

In an invoice factoring agreement, a business sells an outstanding invoice to a factoring company and in return receives a payment(s) to help meet their cash needs. After taking a fee for their service, the factoring company bears the responsibility of collecting the invoice payment from the business’s customer.

Let’s Break it Down

As businesses grow or encounter fluctuations in demand, they may require additional funds to provide services or fulfill orders from customers. Consistent and predictable cash flows are critical for both growing and cyclical businesses. However, without the necessary working capital on their balance sheets to fulfill customer orders or provide services, these businesses may miss out on opportunities to scale or service high value customers.

Traditional bank financing can sometimes fulfill this need through working capital or short-term business loans; however, banks are often constrained in their ability to fulfill this type of financing due to regulatory restrictions or inflexible credit structures. As a result, high potential companies may find themselves missing out on growth opportunities or with diminished performance during periods when sales outpace incoming revenues.

Banks vs. Invoice Factoring Companies

Raising cash by increasing debt may be difficult for companies that are already levered or, like most startups, lack an extensive credit history. In addition, bank approval times for loans can have long time horizons or onerous reporting requirements. Invoice Factoring provides another avenue for companies to raise capital without having to add debt to their balance sheet or waiting on protracted bank approval periods. Businesses can receive funds within a few days through invoice factoring vs. possibly a few months with a bank.

Here’s a Hypothetical Example of How it Works:

A landscaping company, LawnCare, had worked with a hotel chain, Sueño Resorts, for many years. LawnCare workers visit each of Sueno’s 10 beach properties daily – cutting the grass, trimming the hedges and cutting down loose palm branches and coconuts.

Currently, Sueño Resorts pays LawnCare $10,000 weekly for their services. However, Sueño Resorts hires a new CFO who informs the management of LawnCare that because of a new accounting policy, she would like to change the terms of their existing deal from four weekly payments to one monthly lump sum. The CFO explains that if the switch can’t happen, they will have to hire another landscaper.

LawnCare had relied on that weekly cash flow to pay its workers’ payroll and cannot wait until the end of each month to cover the company’s expenses. Instead of cutting ties with Sueño Resorts, LawnCare approaches a Factoring company, Finer Factoring, with their problem. Finer Factoring does their due diligence on both businesses as well as the ongoing invoice agreement, and eventually approves the offer.

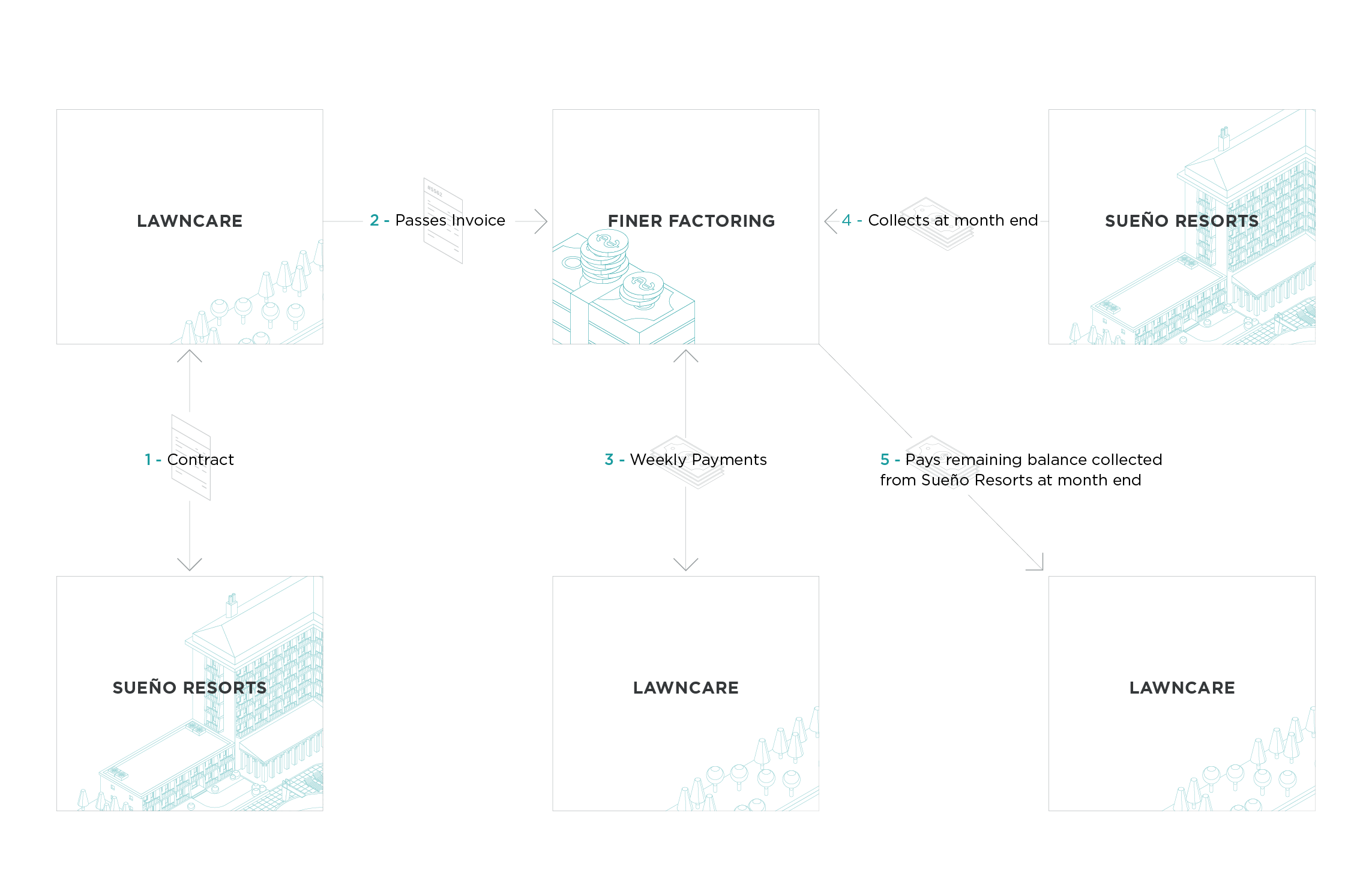

- First, Sueño Resorts and Lawncare agree to the new contract and the monthly invoice arrangement.

- LawnCare then forwards the new Invoice to Finer Factoring.

- Finer Factoring begins advancing a portion (let’s say 90%, or $9,000 a week, for example) of the invoice amount to LawnCare each week.

- Finer Factoring is now the owner of the invoice and collects the $40,000 total from Sueño Resorts directly at the end of each month.

- Finally, Finer Factoring sends the remaining $4,000 ($1,000 x 4 weeks) balance back to LawnCare (after taking out fees and commission for their service).

Why is Invoice Factoring Important?

Consistent and predictable cash flows are important for growing and cyclical businesses that need capital to provide existing or expand future customer orders or services. These types of businesses whose sales outpace their current revenues often find that traditional bank financing is incompatible with their needs due to regulatory restrictions and inflexible credit structures.

Where Your Investment Goes

When investing in an Invoice Factoring Offering, your money goes directly to an originator, (in this case a Factoring Company) whose mission is to provide its clients with the essential working capital they need to grow and expand. The originator seeks to fund undercapitalized, but highly competent businesses that are in the process of expanding their sales or service volume to credit worthy customers.

Why We Like Invoice Factoring Offerings

At Yieldstreet, we like Invoice Factoring offerings because they are they are asset-backed, short-duration and non-correlated. For a similar process, check out our article on Purchase Order Financing. Please also visit our offerings page for all upcoming investment opportunities.

What's Yieldstreet?

Yieldstreet provides access to alternative investments previously reserved only for institutions and the ultra-wealthy. Our mission is to help millions of people generate $3 billion of income outside the traditional public markets by 2025. We are committed to making financial products more inclusive by creating a modern investment portfolio.