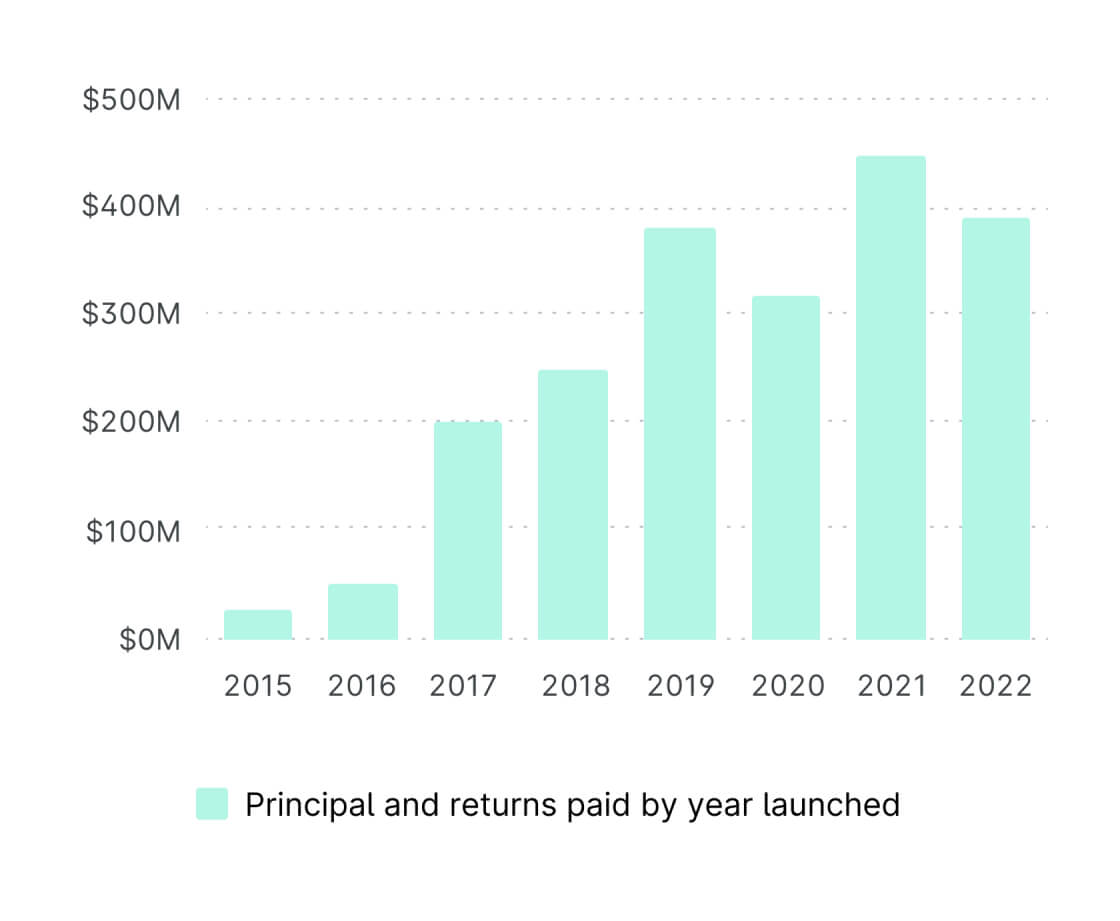

$3.9B+

invested on platform since inception⁹

450K+

members and counting⁹

Broadest selection of alternative asset classes

Highly-vetted investments from institutional managers

More asset classes than any other platform

Balanced

Growth

Income

What sets Yieldstreet apart

Invest with clarity and confidence

Investor support

Easily connect with with a private market professional, or browse our support center for instant answers.

Recommendations

Get a customizable set of investments tailored to your preferences.

Read what our investors have to say

Hear from those who have modernized their portfolios on Yieldstreet.

The testimonials presented on this page have been provided by actual investors in Yieldstreet funds without compensation. Yieldstreet has selected the testimonials, and certain testimonials have been edited to remove personally identifiable information and for brevity. Testimonials were not selected based on objective or random criteria, but rather were selected based on Yieldstreet's understanding of its relationship with the providers of the testimonials. The uncompensated testimonials presented here may not be representative of other investors' experiences, and there can be no guarantee that investors will experience future performance or success consistent with the testimonials presented