Blockchains: A game changer for logistics?

In the headlines: Global supply chain disruptions have plagued almost every industry since the onset of the pandemic, estimated to have cost US businesses alone nearly $1.85 trillion in revenue in 2021, a 22% increase from the year before.

- The Global Supply Chain Pressure Index (GSCPI) is a new measurement the Federal Reserve created to gauge supply chain conditions. Historical data showed while disruptions in the years leading up to 2020 were relatively small and never more than two standard deviations from the average, current conditions are somewhat of an unchartered territory.

The issue began escalating when lockdowns led to a period of suppressed industrial activity amid a growing demand for physical goods, which left manufacturers and distributors scrambling to ramp up production when restrictions were lifted. In the end, demand still far outpaced supply, leading to a chain of disruptions in how many items – like cars, building materials and many tech gadgets – are made and transported around the world.

“It’s like somebody threw a massive boulder into a lake, and it had a big displacement,” said said Ayeh Bandeh-Ahmadi, principal economist at Transfix on the prolonged effects of the pandemic on the global supply chain . “What we’re seeing is the ripples of the remnants of that massive event.”

And while some experts say the peak of the crisis is behind us, many industries are still feeling the impact of raw material shortages, now exacerbated by the Russia-Ukraine war.

This is happening in the context of blockchains gaining momentum as a way to digitize logistics, with companies across a multitude of industries exploring how the technology can be used to streamline their supply chains.

- The Mobility Open Blockchain Initiative (MOBI) made up of automakers like Ford, BMW, Honda, and GM are looking to implement blockchains to track auto parts through production. Other manufacturers, in industries such as aerospace, defense and construction are also following suit.

- Abu Dhabi National Oil Company is a prime example in the oil and gas sector, having successfully implemented a blockchain-based system to track production quantities and execute transactions with different stakeholders.

- US Bank, JPMorgan Chase, Bank of America and IBM are early adopters of blockchain technology in the financial services space, while the tech giant Google became a pioneer in its field in 2019, when it partnered with Chainlink to create a blockchain project that entailed processing future contracts at a safer level.

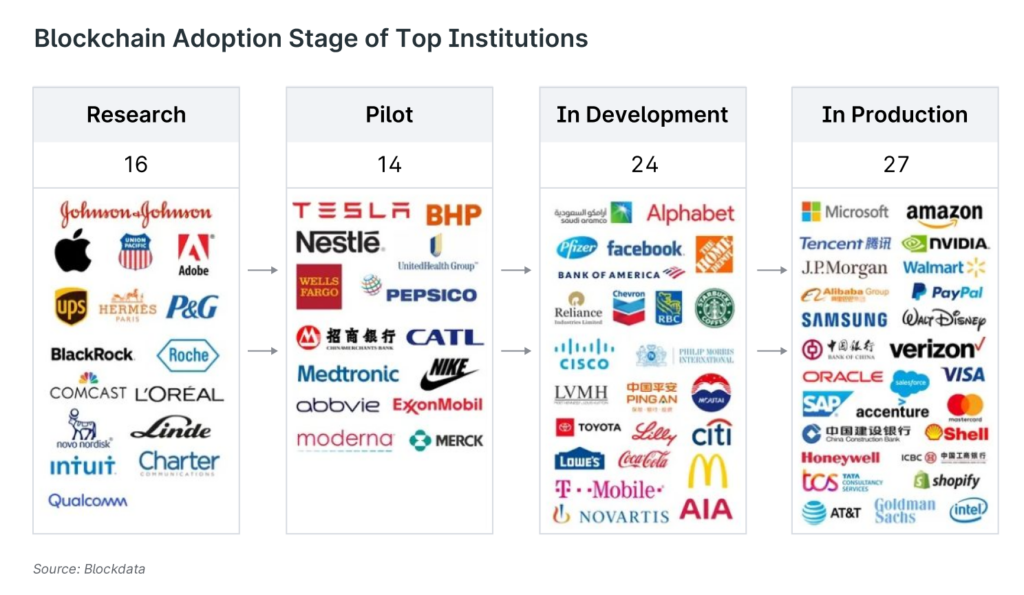

The chart above shows big name institutions at various stages of implementing blockchain tech, many of them specifically looking to it for their logistics process.

Why it matters: Blockchains would allow transparent, efficient and immutable end-to-end tracking of physical assets, making the entire logistics process less prone to prolonged disruptions.

- Essentially databases that store information in a digital format, blockchains are novel for the way they group information into chunks (blocks), that are then strung together to form a chain, where each new data point that’s added is time-stamped within the wider network.

- The goal of this grouping is to allow digital information to be recorded and distributed, but not edited, ensuring a level of transparency and security not possible with paper trails or even the digitized systems in use today, which are prone to cyberattacks and aren’t always immutable.

- With blockchains, it’s also likely that there won’t be a need for intermediaries like lawyers, brokers, and bankers, which would maximize efficiency in industries particularly hindered by long processing times, such as healthcare and financial services.

Between the lines: Supply chain disruptions as a result of the pandemic and the war are expected to persist for the next several years, while similar situations may become more common in an increasingly globalized world.

“Supply will likely play catch up for some time, particularly as there are bottlenecks in every link of the supply chain—labor certainly… but also containers, shipping, ports, trucks, railroads, air and warehouses” said Tim Uy of Moody’s Analytics earlier this year.

And even though the pandemic caused the most widespread supply chain crisis in history, significant inventory shortage and excesses as a result of faulty logistics are nothing new, especially in the manufacturing sector –which makes the entire system ripe for change.

- In 2001, Nike lost $100 million in a single quarter when they went live with a new, supremely complex supply chain system that still depended on paper trails for their products. The company ended up slashing prices to get rid of the additional inventory, putting pressure on margins and profits.

Moreover, logistics related cybersecurity breaches have been hitting all-time highs since 2020, with cybercrime estimated to cost the world more than $10 trillion annually by 2025, which is equivalent to the GDP of the third biggest economy in the world after the U.S. and China.

- The biggest barrier to wide scale implementation of blockchains has been the fact that some industries, like healthcare, are notoriously slow to adopt new technology.

- Also, there are still no direct vendors to purchase blockchains from, which highlights the need to still develop the market infrastructure for the new technology.

Still, blockchain technology is on its way to become the primary way of securely storing and distributing data, with many experts calling wide scale adoption a matter of when and not if.

- According to a survey of top fintech and tech companies by Synechron, 94% of companies had plans related to blockchain initiatives in the near future.

- By some estimates, the market share for blockchains is expected to grow 84.5% by 2030.

Learn more about the ways Yieldstreet can help diversify and grow your portfolio.

What's Yieldstreet?

Yieldstreet provides access to alternative investments previously reserved only for institutions and the ultra-wealthy. Our mission is to help millions of people generate $3 billion of income outside the traditional public markets by 2025. We are committed to making financial products more inclusive by creating a modern investment portfolio.