Investing 101: A comprehensive guide for investing basics

Welcome to Investing 101, a comprehensive guide designed to help you navigate the world of investing. We at Yieldstreet will provide you with the knowledge and tools necessary to make informed decisions and take the first steps towards building a strong and diverse investment portfolio. Let’s get started!

What is investing?

Investing is the process of allocating your money into various assets, such as stocks, bonds, and real estate, with the expectation of earning a return over time. By investing, you are putting your money to work with the goal of growing it, creating wealth, and achieving financial security.

Benefits of investing

Investing offers several benefits, including:

Wealth accumulation

Investing in assets that generate a return allows you to grow your wealth over time.

Financial independence

A well-diversified investment portfolio can potentially provide you with passive income, reducing your reliance on a traditional job and allowing you more freedom and flexibility.

Inflation protection

Investing in assets that appreciate in value can help protect your money from the eroding effects of inflation.

Retirement planning

By investing regularly and strategically, you can build a nest egg that will help support you during your retirement years.

5 ways to start investing

Financial goals

Before you start investing, it's essential to identify your financial goals. These can range from short-term objectives, such as saving for a vacation or a down payment on a house, to long-term goals like retirement planning or funding your child's education. By defining your financial goals, you can develop a focused investment strategy that aligns with your specific needs and objectives.

Long-term and short-term financial goals

Your financial goals can be classified as either short-term or long-term:

Short-term financial goals typically have a timeframe of less than five years. Examples include saving for a wedding, a car, or an emergency fund.

Long-term financial goals have a timeframe of five years or more. These goals often include retirement planning, saving for a child's education, or building wealth for future generations.

Setting realistic financial expectations

When setting your financial goals, it's crucial to be realistic about the returns you can expect from your investments. Keep in mind that the stock market has historically provided an average annual return of around 10% before inflation. However, past performance does not guarantee future results, and your actual returns may vary depending on market conditions, your investment choices, and your individual risk tolerance.

Establishing an investment strategy

Once you have identified your financial goals, you can develop an investment strategy that aligns with your objectives and risk tolerance. Your investment strategy should consider factors such as your investment time horizon, initial investment amounts, and desired asset allocation.

Analyzing time horizon & risk tolerance

Your investment time horizon is the length of time you expect to hold your investments before needing to access the funds. Generally, the longer your time horizon, the more risk you can afford to take on, as your investments will have more time to recover from potential market downturns. Your risk tolerance is your ability and willingness to accept the possibility of losses in exchange for the potential of higher returns. Factors that can influence your risk tolerance include your age, income, financial stability, and investment knowledge.

Determining initial investment amounts

When determining how much to invest, consider your financial goals, risk tolerance, and time horizon. It's often recommended to start with a small initial investment and gradually increase your contributions as you become more comfortable with the investing process.

Building an investment portfolio with asset allocation strategies

Asset allocation is the process of dividing your investment portfolio among different asset classes, such as stocks, bonds, and cash. A well-diversified portfolio can help minimize risk and maximize returns by spreading your investments across various assets, reducing the impact of any single investment's poor performance.

Mutual funds and exchange-traded funds

Mutual funds and ETFs are popular choices for new investors seeking to build a diversified portfolio. These investment vehicles allow you to easily access a professionally managed, diversified portfolio of assets with a single investment. Additionally, index funds, a type of mutual fund or ETF that tracks a specific market index, offer lower fees and often outperform actively managed funds.

Individual stocks and bonds

Investing in individual stocks and bonds can be a rewarding, albeit more complex and time-consuming, approach to building your investment portfolio. While individual securities can offer higher potential returns, they also come with higher risks. Diversifying by building a portfolio of many stocks and bonds can help protect against a loss from one particular security.

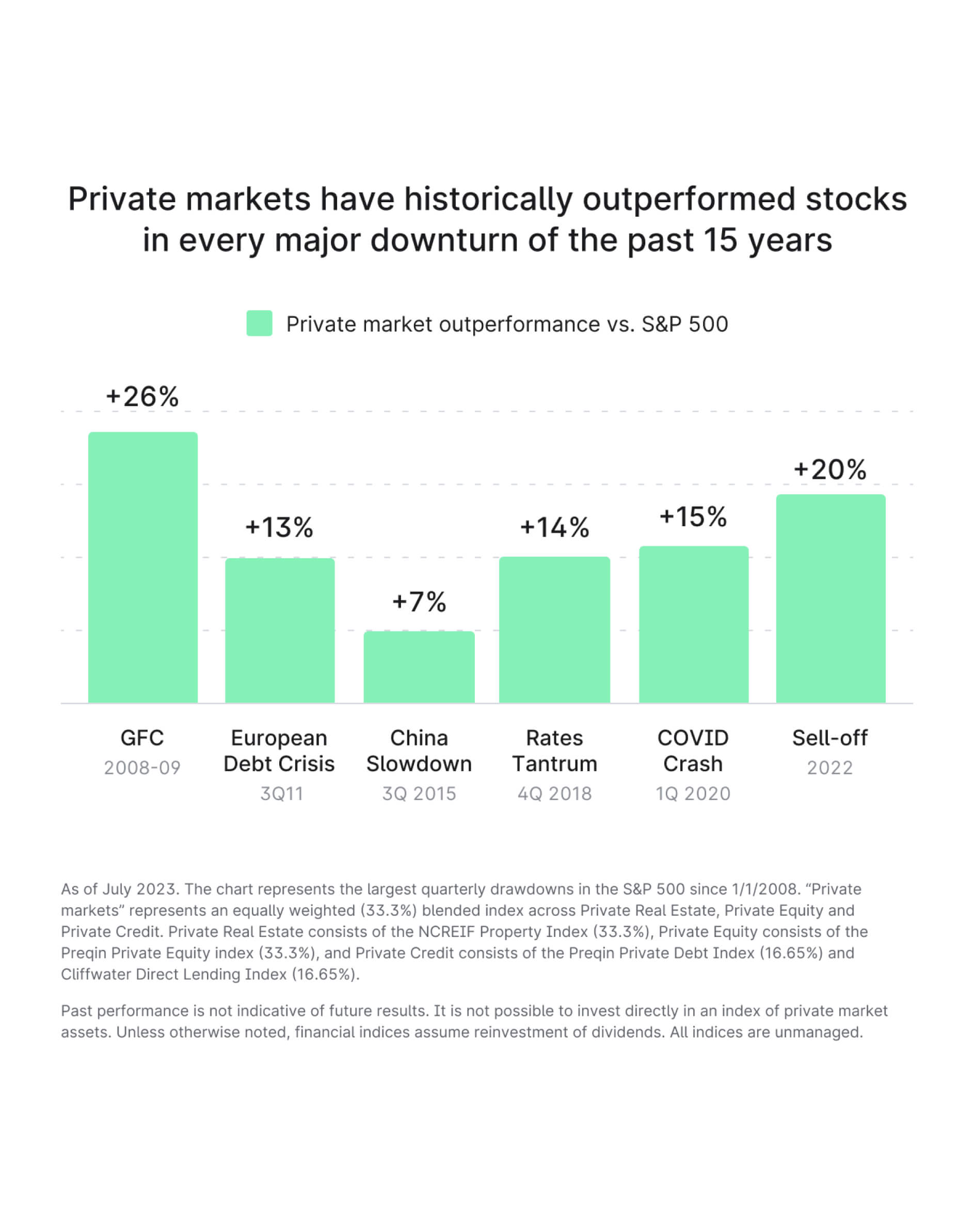

Private market investing

Investing in individual stocks and bonds can be a rewarding, albeit more complex and time-consuming, approach to building your investment portfolio. While individual securities can offer higher potential returns, they also come with higher risks. Diversifying by building a portfolio of many stocks and bonds can help protect against a loss from one particular security. Private market alternatives like real estate, private equity, and private credit can deliver differentiated sources of return relative to traditional stock and bond investments. While access was previously limited for individual investors, institutional investors have allocated upwards of 50% of their portfolios to alternatives for decades. Particularly in periods of economic uncertainty, alternatives have historically delivered stronger risk-adjusted returns, helping protect portfolios from a market downturn.

Similar to stocks and bonds, there are multiple ways you can invest in private market alternatives.

Individual investments: Perhaps the most common alternative investment in the U.S. is purchasing a property that generates rental income or is sold after making improvements. You can also work with an asset provider who sources and manages individual investments on your behalf.

Diversified funds: Investors seeking broader exposure to private markets can opt for funds of alternative investments. These may be specific to one asset class, such as a venture capital fund of startup companies, or multi-asset class.

How can Yieldstreet help?

Yieldstreet is the leading private market investing platform, helping investors diversify their portfolios with alternative assets spanning real estate, private credit, legal finance, art, and more. All opportunities are highly vetted with Yieldstreet’s investment professionals approving less than 10% of the billions of dollars in assets reviewed each year.

Wide selection

Gain exposure to a selection of curated individual investments and diversified private market funds — all in one place.

World-class managers

Yieldstreet partners with some of the most prominent asset managers to unlock investments you can’t get anywhere else.

Strong historical returns

Since inception in 2015, Yieldstreet investments have delivered a net annualized return of 9.6% across market cycles.⁶

Knowledgeable support

Easily connect with a private market investment professional.

Becoming an investor is a journey in which you'll learn how to navigate the world of stocks, bonds, mutual funds, ETFs, and alternative investments. As a new investor, it's essential to define your financial goals, understand your risk tolerance, and develop an investment strategy that aligns with your objectives. By taking the first investing steps and building a well-diversified portfolio, you'll be on your way to achieving financial success and securing your future.

1. Source: Yieldstreet. As of 6/30/2023. Past Performance is not a guarantee of future performance. Target and Realized Net Annualized Returns are calculated using the weighted average of each matured offering. Where targets were expressed as a range, the midpoint has been used. Realized and Target Net Annualized returns are calculated using an internal rate of return (IRR) calculation and only considers management fees and does not consider any additional account-level fees or expenses. Offerings Performed (%) means the percent of offerings that have performed in each category and is calculated by dividing the the number of matured offerings in the relevant category that have performed within 0.5% of their targeted return, or better, by all offerings in the relevant category that have matured. Numbers presented are rounded to the nearest decimal.