Loan Modification Case Study: Los Angeles Pre-Development Financing

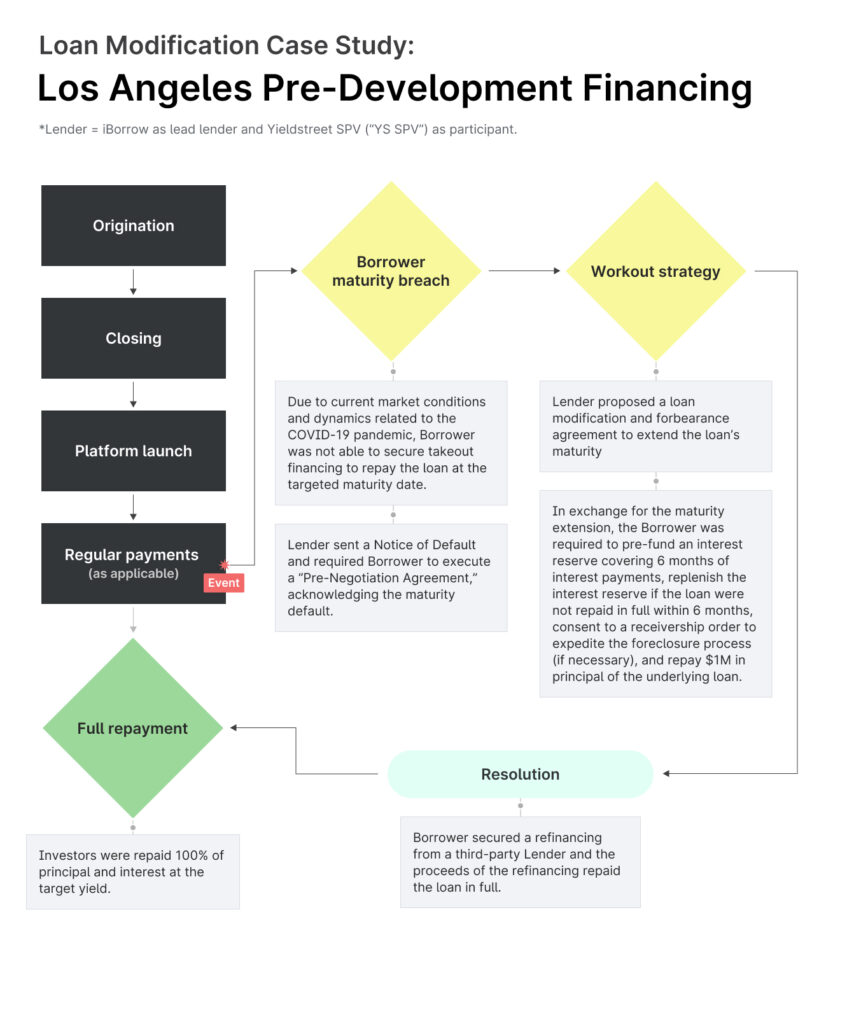

The successful work-out strategy implemented by Yieldstreet and the originator, iBorrow, resulted in a full recovery of outstanding principal and accrued interest for Los Angeles Pre-Development Financing.

In March 2019, we launched Los Angeles Pre-Development Financing on the Yieldstreet platform.

Investors had the opportunity to invest in a first mortgage loan secured by five adjacent parcels of land in downtown Los Angeles. The offering had an expected duration of 21 months, with a target annual yield of 8%.

Due to COVID-19 related market dynamics, the Borrower was unable to secure third-party financing to repay the underlying loan ahead of its stated maturity date.

Yieldstreet and the originator worked with the Borrower to agree to a loan modification and forbearance agreement (“Modification”) that extended the loan’s maturity date by 12 months in order to provide sufficient time for refinancing. The Modification included structural enhancements to the loan, such as pre-funding an interest reserve, making a partial principal paydown, and obtaining a receivership consent order to expedite the foreclosure process in the event that the Borrower did not comply with terms of the Modification.

In July 2021, ahead of the extended maturity date, the Borrower successfully repaid the loan in full. Despite challenging market conditions, we were able to achieve 100% recovery of investor principal and outstanding interest.

Below is an overview of the workout process that achieved full recovery.

What's Yieldstreet?

Yieldstreet provides access to alternative investments previously reserved only for institutions and the ultra-wealthy. Our mission is to help millions of people generate $3 billion of income outside the traditional public markets by 2025. We are committed to making financial products more inclusive by creating a modern investment portfolio.