Key Takeaways:

- Yieldstreet investors helped fund a first mortgage loan originated by Avatar Financial and secured by a full service hotel property in Bakersfield, CA.

- The investment had a 24-month term and 8% target investor yield but pandemic related restrictions forced the borrower to temporarily close the hotel.

- Yieldstreet and Avatar supported the borrower with a series of loan modifcations which helped the borower refinance and payoff in full at the target yield.

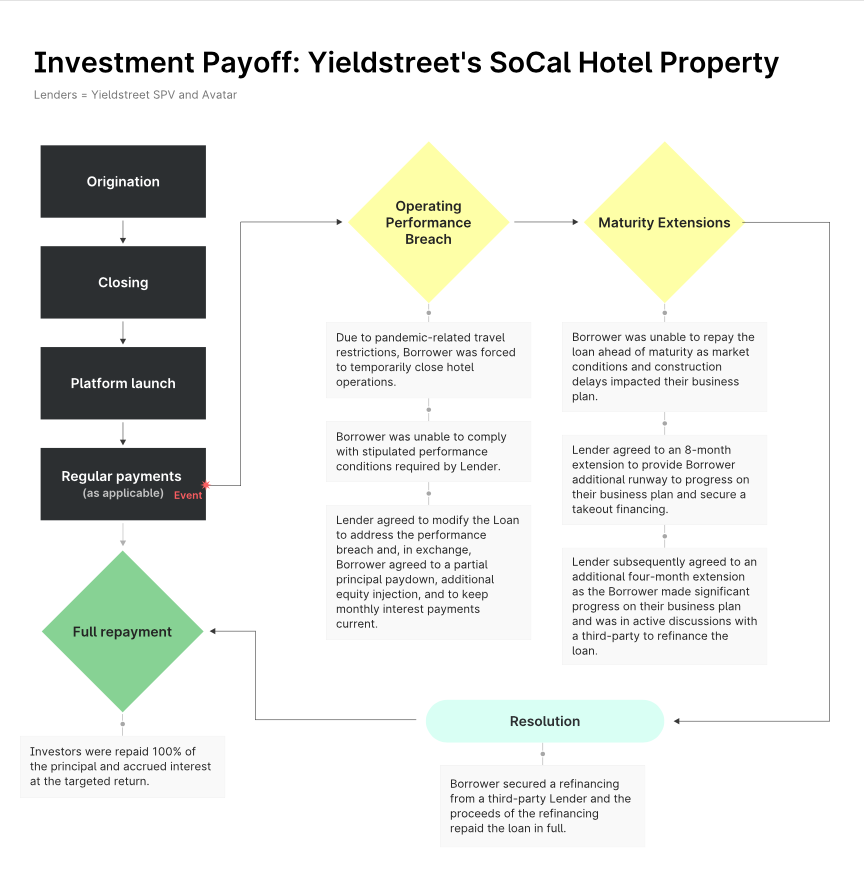

The chart below shows the process that led to full payoff of the investment at the targeted return.

Through challenging market conditions, subpar operating performance, and business plan delays, Yieldstreet and the originator, Avatar, worked with the Borrower over the course of the last three years to achieve a full payoff of the investment at the targeted return for SoCal Hotel Property.

In April 2019, we launched SoCal Hotel Property on the Yieldstreet platform. Investors had the opportunity to invest in a first mortgage loan secured by a 173-key full-service hotel located in Bakersfield, CA, with loan proceeds being used to acquire the property and to fund a deferred maintenance reserve. Initially, the underlying Loan had a 24-month term, with no extension options available.

The property was unexpectedly forced to close its operations in March 2021 as assets across the hospitality sector faced closures due to imposed travel restrictions. Yieldstreet and Avatar worked with the borrower and agreed to modify the loan to address their inability to meet certain operating performance conditions. In exchange, the Borrower repaid a portion of the loan balance, deposited additional reserve funds to be used to complete capital improvements, and agreed to continue to make monthly interest payments at the contractual rate.

The Borrower subsequently progressed on its business plan to rehab the hotel rooms and common areas. However, due to market conditions and continued pandemic-induced delays in construction work, the Borrower was unable to secure a takeout financing to repay the loan ahead of its May 2021 maturity date and requested an extension. Considering that the Borrower had continued to service its debt in a timely manner and had continued to invest a significant amount of their own equity into the project, Avatar and Yieldstreet agreed to extend the loan for eight months, in order to provide the Borrower with additional runway to secure a third-party refinancing.

While the borrower progressed on their business plan to rehab the property, with approximately 70% of the renovation complete – all funded out of the Borrower own equity and continuously monitored by a third-party construction consultant on behalf of the Lender – Avatar and Yieldstreet agreed to an additional four-month extension of the Loan as the Borrower was in active discussions with a third-party to refinance the loan.

We are pleased to report that in February 2022, the Borrower successfully secured a refinancing in the market through a third-party lender and Yieldstreet investors were repaid in full at the targeted return. Despite the challenges the investment faced over the last three years, Yieldstreet was able to keep the investment current and maintained its conviction in the investment due to the borrower’s continued commitment to the property (significant equity injections throughout the investment), negotiated structural enhancements, and strong collateral coverage.

What's Yieldstreet?

Yieldstreet provides access to alternative investments previously reserved only for institutions and the ultra-wealthy. Our mission is to help millions of people generate $3 billion of income outside the traditional public markets by 2025. We are committed to making financial products more inclusive by creating a modern investment portfolio.