Building a modern portfolio requires a modern approach. We believe Yieldstreet has incomparable access to alternative investment offerings with generally low stock correlations. The traditional portfolio model of 60% large-cap stocks and 40% bonds used to be a solid investment strategy, but modern portfolios are increasing their diversification to stay equipped for the ever-changing financial landscape. Keep reading to see how investing in alts can potentially give your portfolio an edge over the investment strategies of yesterday.

What are alternative investments?

The sky is the limit when it comes to what is considered an alternative investment. Generally, however, alternative investments are any investments other than stocks, bonds, or cash. They could be anything from physical assets like art and precious metals to financial assets like venture capital and real estate investing. s.

What sets alternative investments apart from traditional ones?

Alternative investments aren’t typically traded on public markets like the NYSE or NASDAQ. Instead, they’ve traditionally been invested through more exclusive channels like hedge funds, wealth management firms, and between individual ultra-high net worth investors. Alternative investments typically have low correlation to traditional markets, meaning they may perform well when the stock market doesn’t, or vice versa.

Modernize your portfolio away from the 60/40

With bond yields at or near their all time lows and equity valuations historically high, the 60/40 portfolio's foward looking return estimates only 1.4% accordging to AQR. Add private market investments to build your portfolio for the future.

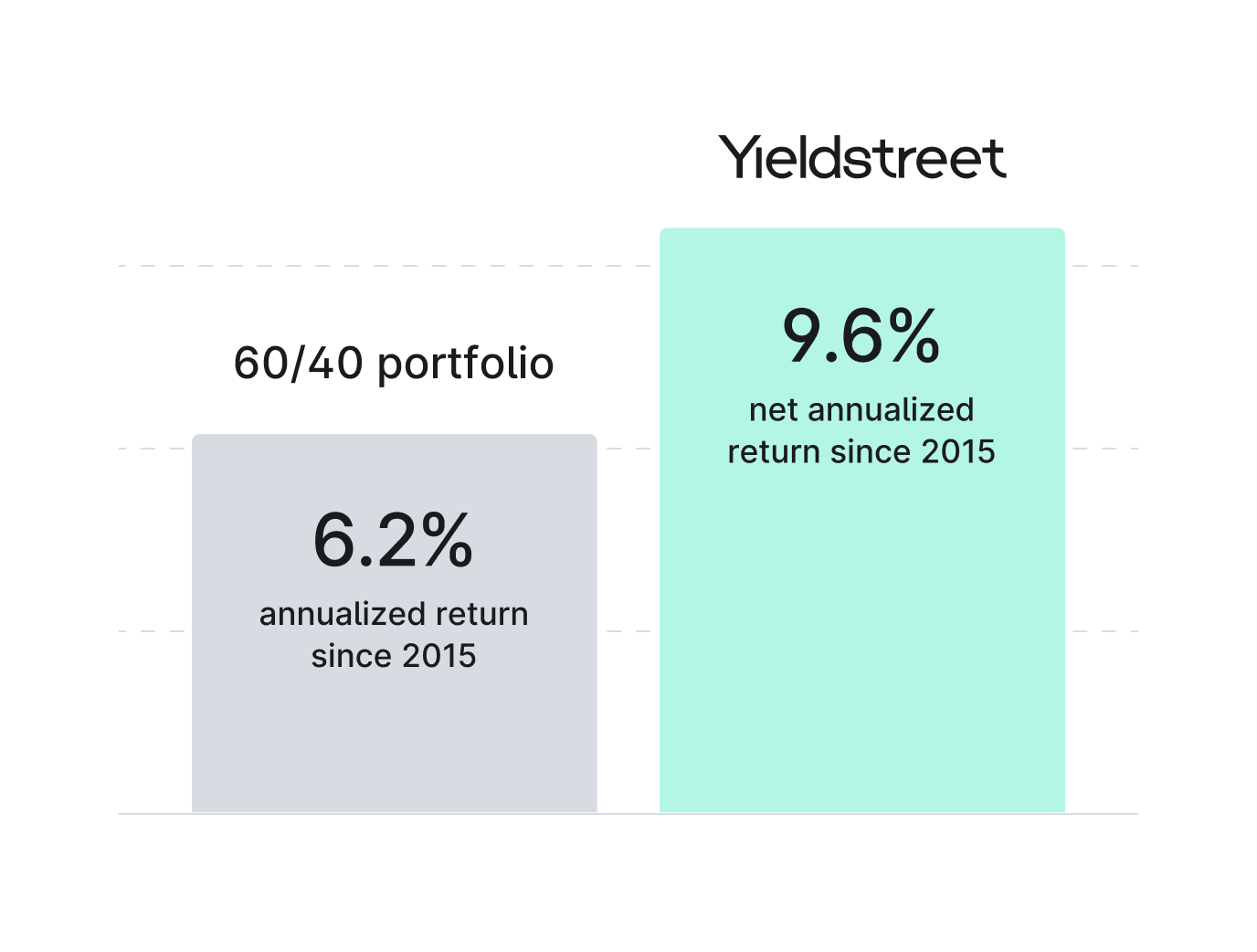

Disclosures: The realized net annualized return represents a historical average net realized return, using an internal rate of return (IRR) methodology, with respect to all matured investments, except our Short Term Notes program, weighted by the investment size of each individual investment, made by private investment vehicles managed by YieldStreet Management, LLC since inception in 2015 through 5/31/23, after deduction of management fees and all other expenses charged to investments. All calculations are based on unaudited internal calculations, are subject to change, and may differ from the fund performance, returns and payments that an investor will actually receive. Numbers presented are rounded to the nearest decimal. The “60/40 portfolio” represents a custom blend calculated by Yieldstreet of the S&P 500 Index (60%) and Bloomberg U.S. Aggregate Bond Index (40%) from Q1 2015 to 6/11/23. Yieldstreet’s historical investment offerings and holdings in a Traditional Portfolio differ materially. Financial indices assume the reinvestment of dividends and do not reflect the impact of fees, taxes and other expenses. Indices are unmanaged, and you cannot make a direct investment in an index. Statistical data of the indices has not been independently verified by Yieldstreet.

Categories of alternative investments

Income

Investments that give you a cash-on-cash return. Example: purchasing a franchise.

Growth

Investments in goods or commodities that do not produce income, but could exponentially appreciate. Example: art, fine wine, coins or gold.

Balanced

Investments that provide both income and growth. Example: purchasing a property that you then rent out to get income while gaining from its growth because of home price appreciation.

Types of alternative investments

See also: What are alternative investments? Your ultimate list

Most popular alternative investments

Real estate and art are often the top performing alternative assets, regardless of broader market forces. Usually considered the “safer” and more predictable alternative to the stock market, inflationary pressures often bolster real estate's potential, as value of real estate holdings go up in times of high inflation. Meanwhile, the global arts market grew from $441.02 billion in 2022 to $579.52 billion in 2023 at a compound annual growth rate (CAGR) of 31.4%.

Why invest in alternatives?

Alternative investments can help diversify your portfolio and reduce your exposure to the stock market while generating inflation-beating returns. Another potential benefit of alternative investments is your ability to invest in them using retirement accounts like your IRA, which provides tax efficiencies.

Benefits of alternatives

Yieldstreet is ideal for savvy investors who are looking to earn higher returns, while diversifying their portfolio. The stock market experienced high volatility over the last several years, as soaring inflation led to aggressive rate hikes. Investors were left scrambling and the market braced for a possible recession. These fears have many investors concerned about where to invest their money in 2024.

Yieldstreet is the perfect way to diversify an investment portfolio with alternative investments, which can hedge against market volatility. Furthermore, you can put your money into art, crypto, private equity, and venture capital all on one platform, and diversify across different investment vehicles.

Considerations of investing in alts

Finding a good balance between risk and return is the first aim of any investment strategy. As with any important financial decision, investing in alts requires taking into account broader objectives versus risk tolerance.

How to access alternative investments

Yieldstreet offers a curated selection of alternative investment opportunities that were previously only available to institutions and the ultra-wealthy and have over 400k members powering our dynamic marketplace of alternative investment products.

You can build a custom Yieldstreet portfolio starting at $10,000 across various asset classes as an accredited investor, while non-accredited investors can get involved by investing a minimum of $10,000 in Yieldstreet's Alternative Income Fund. The Fund allocates capital toward private and structured credit, real estate, legal finance, and art investments, among others.

How much should I allocate to alternative investments?

The traditional 60/40 portfolio is less conducive to growing and preserving capital in volatile environments. In this day and age, with low interest rates and potential inflation, investors should consider investments beyond bonds to help achieve their goals. Investment managers like BlackRock recommend supplementing your portfolio of stocks and bonds with up to 20% in private market alternatives.

The value of Yieldstreet

Yieldstreet brings alternative investments across a variety of asset classes to a single platform, with minimum investment amounts that are typically significantly lower than institutional funds. Depending on the deal structure, our investment minimums typically range from $10,000-$25,000, allowing you more flexibility to diversify your Yieldstreet portfolio across multiple investments, instead of needing to choose only one or two. We aim to provide opportunities for diversification across a variety of asset classes, target returns, durations, and liquidity schedules. Investors like you deserve alternatives to the stocks and bonds of the past, with access to private markets typically dominated by the ultra-wealthy.

Our track record speaks for itself

View our offerings

Your frequently asked questions, answered.

How do I get started on Yieldstreet?

Yieldstreet is free to join, and requires creating an account with your email address and phone number, as well as an identity verification process to ensure compliance with KYC/AML laws. For some opportunities, accreditation is also required which typically involves uploading your last two tax returns to the platform.

How to access alternative investments?

While historically, alternative investing typically required high minimums with large fund managers, platforms like Yieldstreet now allow investors to build a customizable portfolio of alternatives at more attainable minimums.

How to build wealth?

Building wealth can be done by investing in assets that appreciate in the future, as well as maximizing your savings and minimizing expenses.

Are alternative investments safe?

Like all investments, the risk varies from opportunity to opportunity. Typically, higher potentially yielding opportunities involve higher risk, and lower yielding opportunities involve lower risk, but this does not always hold.

How can alternative investments be useful to investors?

Since alternative investments don’t necessarily move in tandem with the stock market, they offer diversification in investor portfolios and potential gains even when stocks and bonds are falling in value.

What is an example of an alternative investment?

Real estate, art, private credit, and private debt are all examples of alternative investments. The category is broad in that it includes any investment outside of traditional stock/bond products.

Alternative investments involve specific risks that may be greater than those associated with traditional investments; are not suitable for all clients; and intended for experienced and sophisticated investors who meet specific suitability requirements and are willing to bear the high economic risks of the investment. Investments of this type may engage in speculative investment practices; carry additional risk of loss, including possibility of partial or total loss of invested capital, due to the nature and volatility of the underlying investments; and are generally considered to be illiquid due to restrictive repurchase procedures. These investments may also involve different regulatory and reporting requirements, complex tax structures, and delays in distributing important tax information. Diversification does not ensure a profit or protect against a loss in a declining market.

Individual investors should contact their own financial , legal , accounting and tax professionals to determine the most appropriate investment options for their financial situation. This material contains the current opinions of the Adviser, and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Some information contained herein has been obtained from sources believed to be reliable, but it is not guaranteed. No part of this material may be reproduced in any form, distributed to others, or referred to in any other publication, without express written permission.